Entrepreneurship

Budgeting and Cash Flow Forecasting. Similar, but not the same

March 23, 2017

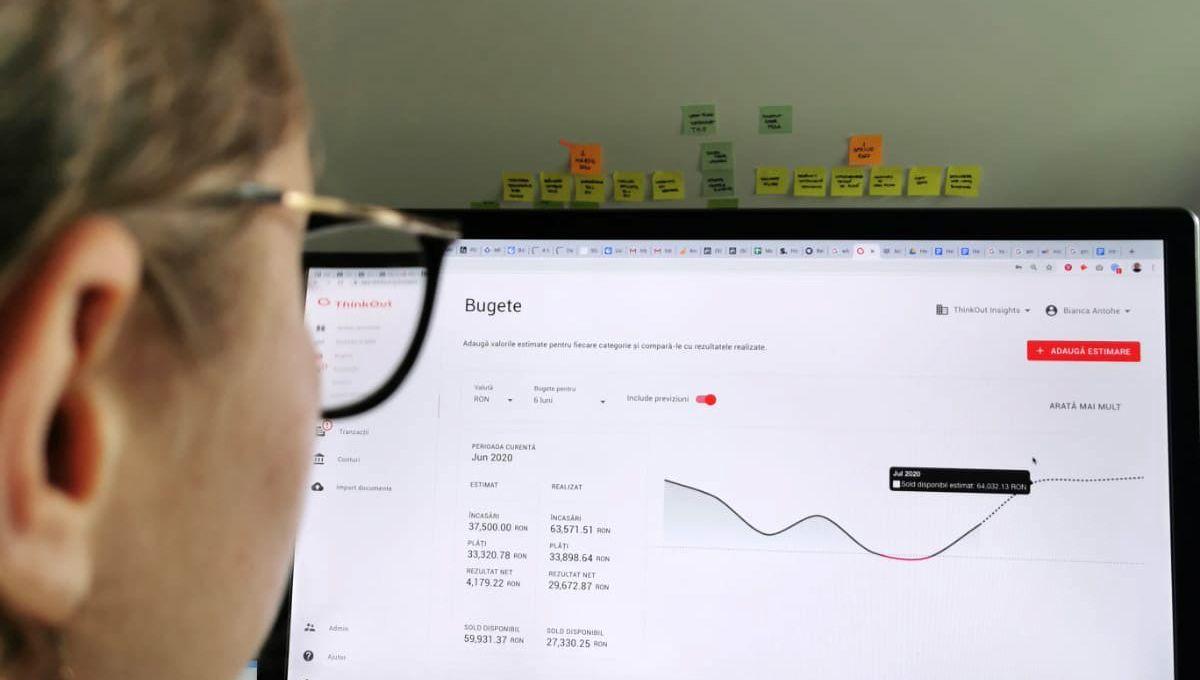

Budgeting and forecasting are some of the most important financial functions and techniques used in the decision-making process by the management team. Even if they don’t mean the same thing, they are strongly linked together, playing an important role when it comes to strategic business cash planning. For instance, a budget is associated with the strategic business plan, mainly focused on profit and allocating resources, while a cash flow forecast monitors future transactions and the cash in the bank accounts, projecting the moments when the receipts and payments are more likely to happen.

Budgeting

A budget is a detailed financial outline, a quantified expectation for what a business wants to achieve over a period of time. Budgets determine how existing financial resources are allocated, usually set by how previous money was spent and expected income. In other words, it is the financial expression of a business plan or a target. Its main characteristics are:

• detailed representation of a business’ future results, financial position, and cash flow over a certain period of time;

• it is usually updated once a year, set for the fiscal year and adjusted based on changing business conditions;

• is used to direct and coordinate business activities to achieve the vision, mission, goals and objectives;

• helps in the control process, determining variances from expected performance (actual outcome is compared with the budgeted outcome);

• it can trigger changes in performance-based compensation paid to employees.

Forecasting

Financial forecasting is quite different from budgeting. A forecast is a projection of what it can happen in a business, based on historical data; an estimation of what will actually be achieved. A forecast can predict the forthcoming financial inflows by evaluating past data and trend analysis. In other words, the forecast is used to see if the company will meet or exceed the expectations from the budget allowing the managers and controllers to set future goals. Its main characteristics are:

• it is typically limited to major revenue and expense line items;

• is is usually updated at regular intervals, on a monthly or quarterly basis;

• it can be used upon operational considerations, such as adjustments to staffing, inventory levels, and the production plan

• changes in the forecast do not impact performance-based compensation paid to employees.

Take ThinkOut for a spin

Create a budget and add forecasts to achieve great business results

Start your 30-day free trialThe key difference between a budget and a forecast is that the budget is a plan for where a business wants to go, whereas a forecast is an indication of where it is actually going. But the two functions are not mutually exclusive from each other. De facto, a good forecast fuels the development of an accurate and efficient budget. Therefore, as a manager, you might want to use the budget to set the goals of your company and a forecast to determine the required adjustments in your company when it comes to operational costs. Both these techniques will keep you focused, as the business changes during the year.

Share this article

One great read. Every month in your inbox.

Our newsletter explores new ideas for entrepreneurs to enjoy financial management and better run their businesses.

Read our blog

Learn more about cash flow management

Cash flow

Budgeting vs Cash Flow Forecasts

Use budgets and cash flow forecasts in order to establish your business' direction.

March 18, 2021

Read more

Cash flow

Understand the cash flow plan

No matter the tool you are using, there are some basic things to keep in mind when organizing your cash flow plan.

January 05, 2018

Read more

Cash flow

How to build financial forecasts for your business

Know where you’re headed by building forecasts of your inflows and outflows.

September 29, 2020

Read more